Last updated: 11 Aug 2025 08:30 Posted in: AIA

An annual review of trends in UK fraud cases highlights the importance of staying vigilant and adopting advanced security measures.

Fraud continues to be one of the most important risks facing businesses, individuals and public institutions. The past year has seen a shift in both the methods used to perpetrate fraud and the responses from businesses and regulators. The rise of sophisticated AI and tech-driven frauds has reinforced the need for robust fraud prevention strategies, while increased regulatory scrutiny and new legislation is prompting organisations to take fraud risk management more seriously.

For over 20 years, BDO has been producing an annual review of trends in UK fraud and economic crime cases over £50,000 that have been reported in the public domain. This year’s survey has revealed several interesting trends and new fraud risk factors. Statistics can only ever provide a partial picture of the scale of the problem, given that it is widely accepted that fraud remains vastly under reported.

However, fraud trends are certainly something businesses should pay close attention to, not least because from September this year the Economic Crime and Corporate Transparency Act (ECCTA) 2023 introduces a new corporate criminal offence for failing to prevent fraud. Despite ongoing efforts to combat financial crime, perpetrators of fraud remain highly adaptable in exploiting new technologies, regulatory gaps and human vulnerabilities.

The full publication of FraudTrack 2025 can be accessed at but we shine a light here on four headline topics from this year’s study:

Money laundering surge

While money laundering isn’t always reported as fraud, illicit gains from fraudulent activities often need to be processed through financial systems. With fraud prevention and anti-money laundering high on the agenda for regulators and government agencies, companies are being encouraged to view these offences through a combined lens.

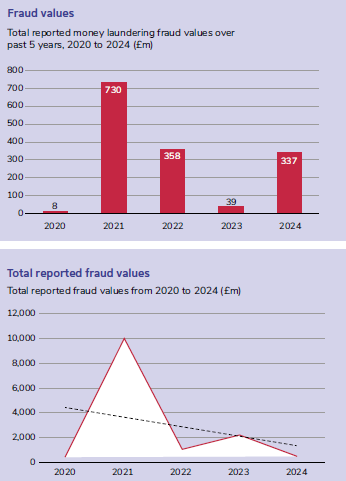

FraudTrack revealed that, in 2024, money laundering was the largest category of reported fraud and economic crime by value, which at £337 million represented 61% of the total value.

The average reported value of money laundering in 2024 was £19.84 million, a ten-fold increase on the 2023 average value of £1.96 million.

The majority of the £337 million total value of reported money laundering matters in 2024 related to two large cases: a gold money laundering case totalling £266 million; and a £55 million money transfer laundering case.

The scale of the money laundering problem in the UK is put into stark focus by the National Crime Agency’s latest National Strategic Assessment of Serious and Organised Crime 2025, which highlights that there is a realistic possibility that over £100 billion is laundered through and within the UK each year. This makes money laundering a critical consideration in how corporate entities assess their financial crime risk management frameworks and risk assessments.

While money laundering represented the highest value of frauds, ‘non-corporate fraud’ such as phishing scams and identity theft was the most common fraud type by number, representing 41% of fraud cases reported in 2024. This is the second highest count of non-corporate frauds recorded in FraudTrack since 2019.

The largest non-corporate fraud case last year saw a five member Bulgarian gang orchestrate a £50 million scam against the Department for Work and Pensions (DWP). Their scheme revolved around fraudulent Universal Credit claims, with thousands of recruits in Bulgaria falsely posing as UK residents and workers. To maximise payouts, the gang even created fictitious identities for children, exploiting the system on a massive scale.

Overall reported fraud and economic crime values decline

The value of reported fraud and economic crime in the UK fell to £550 million last year, down from £2.3 billion in 2023 amid a 63% drop in high-value fraud cases (those exceeding £50 million).

The fall in reported fraud values broadly follows the five-year downward trend in reported fraud, with 2021 remaining a significant anomaly standing out as a peak year due to the surge in fraudulent activity during the COVID pandemic.

Alongside the steep decline in total reported fraud value in 2024, the number of fraud cases has also seen a 16% drop, although interestingly the five-year trend shows an upward trajectory and remains broadly steady.

Retail sector hit hardest by fraud

Examining industry data reveals clear distinctions between how hard different sectors were impacted by fraud and economic crime. Understanding these trends can help to identify where fraudsters are striking most and how risks are evolving.

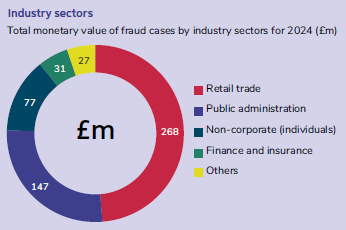

The retail sector saw a significant rise in reported fraud this year, making it the most vulnerable sector to fraud and accounting for almost half (49%) of fraud by value in 2024. This was followed by fraud affecting the public sector.

Reported differences in fraud statistics across sectors will inevitably be heavily influenced by the largest value frauds in that reporting period. Notwithstanding this, the nature of the retail sector does mean that it presents a range of opportunities to commit fraud, particularly if monitoring and controls are not effectively managed. Key risk factors in the retail sector include:

Artificial Intelligence and fraud

Like any technology, AI can be misused and this is especially true when it comes to fraud. We have seen a huge step forward in the capability and accessibility of AI tools in recent times and that trend is expected to continue to offer fraudsters massive opportunities for technology-enabled fraud schemes.

A recent survey by NatWest found that AI voice cloning scams appeared to be one of the fastest growing types of fraud in 2024, having targeted up to 30% of respondents. Synthetic identity fraud is also expected to become even more commonplace. Here, fraudsters create new identities based on stolen data from genuine individuals that is then enhanced through generative AI. These scams often involve creating fake social media profiles, which are becoming increasingly challenging to detect.

Fraudsters will continue leveraging AI to increase the scale and success of their schemes. The challenge for the anti-fraud community is to harness AI prevention and detection while staying ahead of emerging threats. While technology already plays a crucial role in fraud risk management and fraud detection, there is still much more it could be doing. Automation can help in many areas, from data analytics and identifying suspicious transaction patterns, to AI driven risk assessment and detecting discrepancies between customer profiles and transaction behaviours.

In the BDO Fraud Survey 2024, we found:

These findings suggest that while some businesses have been proactive in their investment in technology, there appears to be considerable scope for others to step up their commitment to IT security. The boom in the development of AI technology remains a double-edged sword in the fraud arena, serving as both a powerful tool for detecting and preventing fraud while also being a potential enabler. Which of these two competing adversaries will be most successful in utilising AI technology will have a big impact on shaping the results of future FraudTrack findings.

Author bio

Stephen Peters is Partner, Head of Investigations at BDO, and has been involved in a wide range of forensic accounting projects.

Richard Shave is a Director in BDO’s Forensic Accounting team in London with over 25 years’ experience at the firm.