The Global Business Account You Can Bank On

Airwallex helps businesses grow without limits. Manage multiple currencies from one account with no monthly fees, enjoy bank-beating transfer & FX rates, and cut the cost of global payment acceptance.

Airwallex Benefits

Key Industry Verticals

Airwallex helps clients across a range of industries streamline their finances and push into new markets.

Airwallex and AIA

Refer your clients to Airwallex and they will receive £10k free FX.

Refer Now

Latest Insights

Find out why award-winning SaaS company ApprovalMax chose to partner with Airwallex to support their global expansion.

ApprovalMax is an award-winning SaaS company that helps businesses and accounting firms automate approval processes for accounts payable and receivable. Headquartered in the UK, they operate across global markets and employ staff in over 24 countries.

As a truly international business, ApprovalMax needed a financial solution that would enable them to collect, spend and manage money globally without being subject to costly FX conversions. So they decided to partner with Airwallex.

As part of our strategic partnership, Airwallex has integrated with ApprovalMax’s software. This means that ApprovalMax customers can pay their global bills efficiently and cost-effectively using Airwallex technology.

Helmut Heptner

Co-Founder and Director of Operations, ApprovalMax

“Our partnership with Airwallex opens up an exciting dimension around approvals and payments. ApprovalMax is thrilled to integrate with Airwallex – our focus is on enhancing the customer experience so it’s easy, frictionless, and convenient all the way through.”

How ApprovalMax took control of their global finances

ApprovalMax had three major challenges to solve as they scaled globally.

Crucially, ApprovalMax wanted an end-to-end financial solution which would allow them to manage all their financial transactions — from payment acceptance and transfers to employee expenses — on a single platform.

Airwallex provided an ideal solution to these challenges.

With an Airwallex Global Account, ApprovalMax can now collect, hold and send multiple currencies around the world without being subject to unnecessary FX conversions. For example, they can collect revenue from their US customers, hold those US dollars in their Global Account, and use them to pay staff and suppliers in the US, all without being subject to fees.

If they do wish to convert currencies, they can hedge against risk and convert at a time that is beneficial to them. And they save up to 80% versus high street banks with our market-leading FX rates.

Airwallex Borderless Cards provide ApprovalMax with the perfect solution for managing global expenses. Employees can now spend globally with no international fees, and spend FX-free in 11+ currencies held in their Global Account. Airwallex's in-built expense management software allows the ApprovalMax team to keep track of all global spending in one place. Employees simply upload receipts and invoices to the Airwallex app, and all expense data is automatically reconciled in Xero, saving them hours of admin each month and helping them close their books faster.

Competing as an international player

Helmut Heptner

Co-Founder and Director of Operations, ApprovalMax

“Airwallex covers everything which small businesses need to act like the bigger players on a global level. We can transact in local currencies with customers in local markets. ApprovalMax has total control over the flow of cash in different currencies. We have the ability to do all kinds of local payments and international payments. It breaks down barriers.”

Challenge

Solution

Airwallex propels businesses towards exponential growth

Global businesses like ApprovalMax need financial solutions that break down barriers and allow them to operate locally as they scale in new markets.

Airwallex's end-to-end payment solutions allow ApprovalMax to manage money globally without high fees, meaning they can collect revenue in their customers' preferred currency, pay global suppliers quickly and efficiently, and manage expenses across regions, all without being subject to unnecessary fees.

ApprovalMax has now integrated Airwallex's global payment technology with their own software, thereby extending Airwallex's benefits to their own customers. With the Airwallex integration in place, ApprovalMax customers can pay international bills in a click, without losing money in FX fees.

James Scobie

Senior Channel Partnerships Manager

“ApprovalMax is an exciting new partnership for Airwallex bringing together two innovative and complementary products for the SME market. By adding Airwallex payment functionality to ApprovalMax, customers avoid the hassle and cost of making payments internationally, and can concentrate on growing their business globally.”

Emerging card issuing technology is driving change and innovation across industries, empowering businesses of all kinds — from eCommerce platforms to ridesharing apps — to offer cutting-edge financial services to their customers.

Alternatively referred to as “API card issuing” or “modern card issuing”, this new trend in the world of embedded finance allows businesses to build their own card program, tailored to their specific use case. Increasingly, companies are choosing to issue their own payment cards to users, allowing them to spend money directly within platform, without ever moving it into a bank. A prime example being Uber, which now issues cards to its drivers, enabling them to collect and spend revenue all within a single app.

In this article, we'll dive into the different ways businesses can use card issuing to upgrade their product offering. We’ll also cover the card issuing product that Airwallex offers, and show you how our full stack solution and flexible APIs can help you go to market faster than competitors, and scale your card issuing program globally.

Let’s briefly have a look at how traditional card issuing worked in the past.

Unless you were a business, such as a major bank, that had the necessary infrastructure and resources to issue your own cards, you needed to partner with various intermediaries to issue bespoke cards branded for your business.

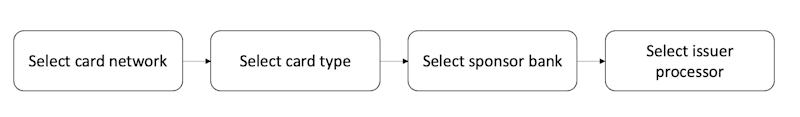

On a high level, this process would include the following steps:

Selecting the card network. This is the core of your payment infrastructure. The four major networks are Visa, MasterCard, American Express, and Discover.

Selecting the card type. The main card types available are credit cards, debit cards, and prepaid cards, each with their own unique features and benefits.

Selecting the sponsor bank. A sponsor bank is responsible for facilitating the transfer of funds from end consumers to merchants and for ensuring that payments are properly processed.

Selecting the issuer processor. An issuer processor is responsible for managing the issuance of cards, authorising or declining transactions, maintaining the system of record for cardholder data, communicating with settlement entities, and facilitating card issuing on behalf of the issuing bank, while connecting directly with networks to do so.

For many years, this traditional card issuing infrastructure effectively served the purpose of transferring money within certain limitations, but it never really provided a unique advantage for the business. Any customisation would require the business to start the process again, resulting in lengthy development cycles. This meant that any future adjustments to meet the evolving needs of the business would also require starting the process over, hindering the ability of innovators to respond to changes in the market.

To stay competitive and adapt to the fast-paced changes in the market, many businesses started embracing a digital-first approach to payment services. This shift has been driven by technologically advanced companies such as Uber and DoorDash, which have led the way in the development of distributed, fault-tolerant applications since the early 2010s. The resulting boom in the card issuing field has led to the emergence of a new phenomenon – card issuing using flexible Application Programming Interfaces (APIs).

Is this card issuing process totally different to the traditional one? Yes and No.

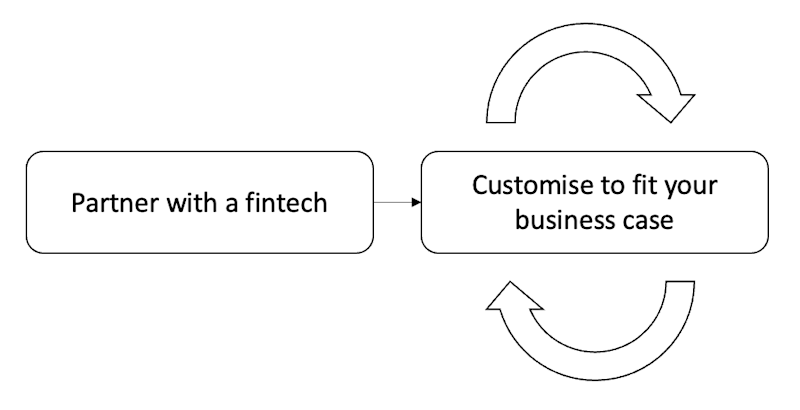

If we take a high-level look at the process of API card issuing, we can identify the following steps.

Partnering up with a full stack fintech partner. A full stack fintech partner takes on the burden of finding sponsor banks, issuing processors, selecting card types and dealing with KYC. Having a full stack solution allows you to create an account and issue a card without needing to find a bank sponsor, which is especially beneficial for startups. Airwallex offers a full stack card issuing solution.

Customising the card products to fit the business case. One of the main benefits of API card issuing is its ability to adapt to changing business needs without requiring a complete overhaul of the initial card issuing process.

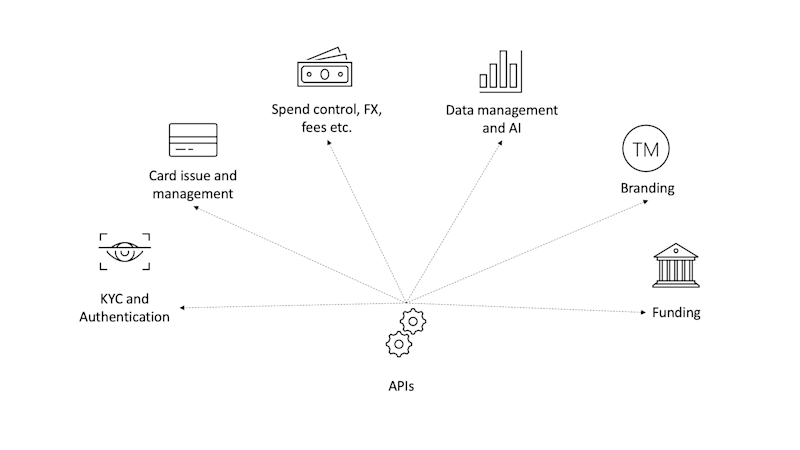

APIs are at the core of this new card issuing process. APIs play a vital role in embedded finance as a whole, especially in the context of Open Banking. So, how do these APIs enable such a high level of flexibility? Let's take a closer look.

Financial institutions have historically been required to follow the ISO 8583 standard for exchanging electronic messages about financial transactions. However, open APIs have broken this complex payment flow down into smaller, more easily understood APIs that use JSON data format, making it easier for developers to work with while still adhering to ISO 8583 requirements.

In the overall scope of card issuing, each function has its own dedicated API, such as handling KYC, issuing a card, or authorising a payment. These APIs can also work with customer data and use artificial intelligence to offer additional services that span beyond traditional finance, such as personalised spending advice and enhanced security by identifying suspicious transactions or unusual patterns. Open APIs also allow for integration with other applications, services, or platforms.

There are many fintech companies that offer API card issuing services partially or fully. However, it is crucial to select the right partner that has the expertise and experience to deliver solutions tailored to your specific needs. Don't settle for a one-size-fits-all approach – make sure you select a fintech that is the right fit for your use case.

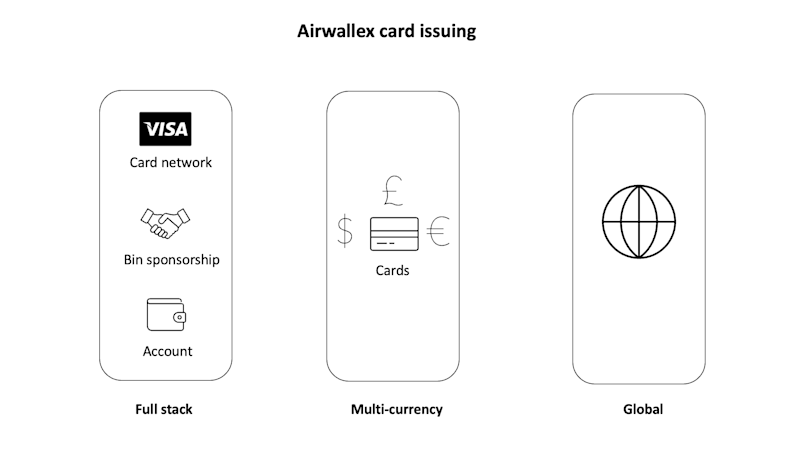

At Airwallex, we have established ourselves as a reputable payment business with a strong foundation of real-world use cases and continuous support for our customers. Our extensive experience in the payment industry and our partnership with global banks and the Visa card network, allows us to confidently offer our assistance to your business by our API card issuing solution. What sets Airwallex apart from the competition is the perfect blend of these three key elements.

Full stack – Thanks to our global licences and banking partnerships, we've got you covered for BIN (bank identification number) sponsorship, so you can create accounts and issue cards through Airwallex without the need to manage a banking relationship yourself. Our partnership with Visa means you take advantage of the extensive reach of the Visa network and complete transactions in over 200 countries and territories using our physical and virtual multi-currency debit cards. We also take care of KYC and compliance.

Global – Our products are available to companies across various geographic regions. For instance, if your business is based in the UK but you have offices in the US, you may want to consider setting up a US account with Airwallex instead of using your UK account to make transactions in that region. This way you can avoid incurring foreign exchange fees or transaction fees. Airwallex's global coverage enables you to set up accounts in multiple locations so you can issue local cards rather than international cards to your customers.

Multi-currency - Airwallex accounts offer multi-currency wallet functionality, enabling transactions in a variety of currencies, including USD, AUD, CAD, SGD, NZD, HKD, JPY, EUR, GBP, and CHF. Our expertise in Foreign Exchange (FX) allows us to provide seamless integration of various solutions, ensuring access to the best FX prices and transaction services that align with the specific needs of your business.

Go to market fast - Airwallex offers a tried and tested white label card solution that allows businesses to quickly bring their own branded cards to market. Once development is complete, businesses can test transactions in the demo environment and then go live in production by simply changing API keys and redirecting endpoints. Our APIs are flexible and have a data structure that can easily be integrated with various back-end systems. Airwallex is here to make the card issuing process easy for you. As a customer, you won't need to worry about BIN sponsorship, card production, transaction processing, or balance management.

Secure - Airwallex has achieved the highest level of PCI compliance (PCI-DSS Level 1) and will handle all PCI requirements on your behalf. We'll also handle all KYC and other compliance requirements, so you can focus on growing your business. Plus, we are fully compliant with Strong Customer Authentication (SCA) in the UK and PSD2 across the EU.

With flexible APIs, card issuers can instantly and securely work with API tokens, which replace sensitive card information such as a personal account number (PAN) or a personal identification number (PIN). API tokens can be securely stored online with merchants or directly in digital wallets for recurring and one-click payments.

The granular nature of open APIs allows businesses to maintain dedicated APIs that can actively use customer payment data to benefit the business and customers. For example, using Airwallex APIs, you can offer real-time spend tracking to your customers, helping them to better understand and manage their spending habits. Additionally, you can set custom spend controls on cards, which can be useful for corporate cards issued to employees. With Airwallex, you also have the opportunity to generate additional revenue through interchange fees.

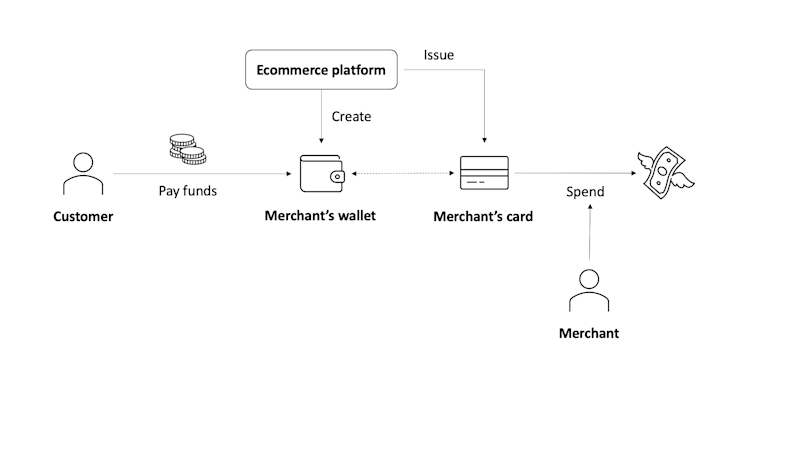

An eCommerce marketplace can create multi-currency digital wallets for their merchants and directly issue digital cards that are linked to those wallets. Merchants can then collect revenue from their product sales directly into their wallet, and can spend the funds right away using their cards.

By integrating Airwallex's APIs, an eCommerce marketplace can not only offer its customers the convenience of digital multi-currency wallets and linked cards, but also enhance the overall user experience with advanced fraud detection and the option to offer additional products such as lending or insurance based on the customer's spending data. This helps to create a more secure and personalised payment process for the eCommerce marketplace customers.

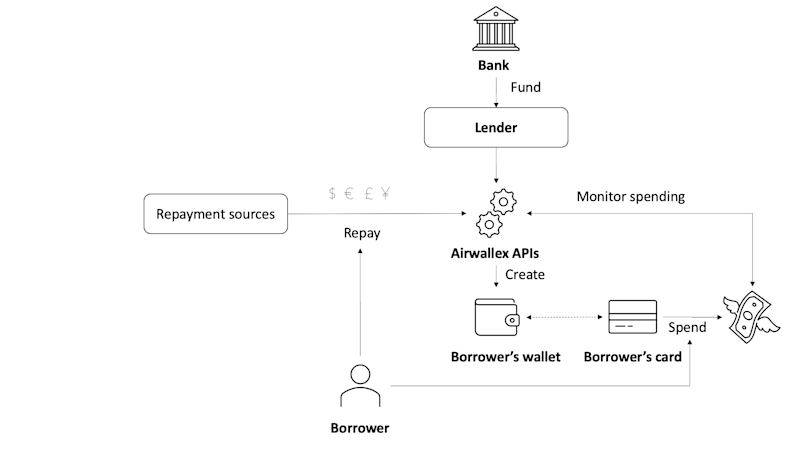

A lending business can integrate Airwallex technology into their platform in a similar way by creating multi-currency digital wallets for each of their clients and issuing cards against these wallets. The business can then use the wallets to promptly deliver funds to the clients and collect repayments directly once funds are received from external sources. At the same time, the clients can use their cards to spend the funds. Using Airwallex APIs, the business can also gain real-time insights into the spending habits of their clients and adjust their funding offers accordingly. This allows them to offer more flexible, comprehensive, and user-friendly financial products.

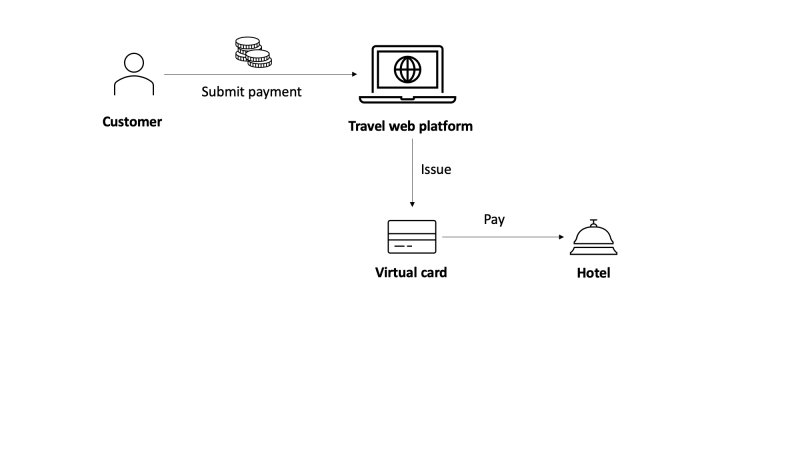

If you operate a hotel booking business, for example, you can use the Airwallex card issuing solution to process payments across multiple jurisdictions without incurring fees.

As an example, when a customer makes a payment on your digital travel platform, the platform can use Airwallex's APIs to issue a virtual card that is subsequently used to pay the hotel once the funds have been received. The global nature of Airwallex cards means you can avoid transaction fees when paying hotels around the world.

There are many ways that API card issuing can benefit your business. The flexible and highly customisable nature of APIs can meet the majority of today's business requirements and provide a strong foundation for future developments in your industry.

By choosing Airwallex as your card issuing partner, you can deliver the best service to your customers today, knowing you can easily adapt your services for tomorrow’s market. Our customisable card issuing solution, backed by our global banking licences and extensive experience in business payment processing, can help you take your platform to the next level.

If you're interested in learning more, our team of experts are here to evaluate your specific requirements in more detail. Don't hesitate to get in touch.

Richard Goold is a Partner at Wilson Sonsini, a law firm which represents technology companies, from early-stage startups to household names. They IPO’d both Google and Apple, and recently advised Twitter on its USD44 billion exit to Elon Musk.

Richard works in the London office, advising European businesses on one of three things:

Wilson Sonsini work with our partners at Seed Legals, offering advice to businesses that are looking to raise capital. We spoke to Richard to find out how European businesses can best position themselves to secure investment from Venture Capitalists (VCs) in the US.

Why raise capital in the US?

Whilst the VC market is growing in Europe, it’s still relatively nascent compared to the US.

“The VC market in the US is a lot bigger and more diverse than it is in Europe. VC has been successful in the US for a long time, it’s driven bigger outcomes, and therefore you have investors who’ve got the ability to take a longer and broader view,” says Richard.

That’s not to say there aren’t European investors who share this mindset, but the US offers a larger pool of VCs with a proven model for investing in businesses that have driven profit, giving them the opportunity to be more aggressive and take bigger bets.

In addition, the macro headwinds of inflation and currency volatility have made the European market anxious. Whilst early-stage funding remains relatively strong, later-stage growth funding has been squeezed and investors have become more cautious.

Meanwhile, US VCs have shown increasing interest in European businesses in recent years, particularly when it comes to later-stage financing. So naturally, UK and European businesses are turning to the US to plug the growth funding gap.

Building a US presence

As a general rule, US investors want to work with European businesses that have already built a presence in the US. According to a survey from Wilson Sonsini and UK data company Beauhurst, just 1.9% of UK companies which successfully raised Seed and Series A funding in 2018/19 from US-based venture capital funds were able to do so without launching operations in the US prior to financing.

There are some industry-specific exceptions to this rule, namely in the BioTech and FinTech spaces. But for most businesses, US expansion needs to come before US fundraising efforts, not the other way around.

“US investors are typically going to be focussed on how to help the companies in their portfolio grow. That’s not just about deploying capital, it’s about network, it’s about connectivity, it’s about knowledge of growing in that market,” says Richard. “The most successful companies that raise investment from the US are typically ones that already have a US story. And typically those outcomes in terms of exits or IPOs tend to be larger than just European outcomes.”

Richard’s advice to European businesses that are looking to expand to the States is:

What US investors are looking for

GBX is a network for British entrepreneurs, executives and investors living in the Bay Area. During a recent roundtable they discussed the key differences between UK and US investors.

A recurring theme was that UK investors play for profitability whilst US investors play to win. Whilst short-term profitability is desirable to US investors, the prospect of winning market share and achieving maximum growth is more attractive, and investors are prepared to accept risk in order to achieve that.

In other words, in order to stand out in the competitive US market, you need to position your business as a potential category leader. To achieve that, you must have world class people and product vision, and be able to demonstrate that you can execute fast and scale in a large market.

“The bar is pretty high,” says Richard. “If you’ve got a West Coast VC, then you’re competing against all of the entrepreneurs in the Bay Area. You’ve got to have big ideas, you’ve got to be able to show that you can execute against a plan, and you’ve got to be able to show that you can build a market leader in whatever it is that you do.”

Become a global winner from day one

If you’re an entrepreneur with the vision to scale, it’s crucial that you set yourself up for expansion from day one.

Whether your plan is to establish your business domestically then make the move to the US, or to be a transatlantic enterprise from the outset, you must put in place tools that will enable a frictionless transition as you scale.

One important factor to consider is your financial infrastructure. As a global business, you need financial solutions which will allow you to receive and send money around the world without exposing yourself to currency risk or high FX rates.

Here’s where Airwallex comes in.

With an Airwallex Global Account, you can open 12 foreign currency accounts (including a USD account) online, from the comfort of your home or office. You can manage all your foreign currency accounts from a single platform, and view all your transaction data in one place.

Each account comes with local account details (IBANs) allowing you to easily trade in the markets which you expand to. That includes paying team members and suppliers, and accepting payments from your global customers.

If you’re a European business that successfully secures investment from the US, you can receive funds into your Airwallex USD account without converting them to your home currency. That way you can continue your US expansion efforts without losing a hefty percentage of the funds you’ve raised to FX fees, or exposing yourself to currency risk.

Airwallex is designed to scale with your business, and includes a host of additional features such as multi-currency physical and virtual cards, online payment solutions and market-beating FX.

It’s been almost 15 years since the first online-only challenger banks burst onto the scene, promising to change the way we manage our money. Since then, a slew of FinTechs – from multi-currency payment platforms to accounting software – have reshaped our perception of modern business finance.

With online banking and WealthTech services making it easier than ever to switch providers, savvy CFOs, entrepreneurs and sole traders are shopping around for a better deal. They are looking for improvements both in fees, and for broader benefits such as customer service, platform capabilities and ethical policies.

This has resulted in an interesting shift across the industry. Traditional institutions are scrambling to up their game, buying up tech solutions and introducing their own environmental policies in an effort to contend with their more agile competitors and offer a more client-focused experience.

In this article, I’ll look at some of the most significant changes we’ve seen in recent years, and the implications for businesses and financial institutions going forward.

Ethical finance

Can a company call itself ethical if its bank invests heavily in fossil fuels? That’s a question you can expect to hear a lot over the coming years, especially as more businesses push to become B Corps.

In a smart PR move, Starling Bank has positioned itself as an ethical choice for businesses and consumers. But whilst Starling’s policies extend to paying workers a living wage and not investing in arms or tobacco, their stance on the environment is murkier. Starling claims that being online-only reduces its carbon footprint, but is that enough to convince modern businesses (and their customers) that the bank is truly sustainable?

Triodos Bank takes things ten steps further by limiting its investments to organisations that focus on the environment, culture and people. Triodos is also committed to transparency, and lists every business they lend to on their website.

In response to mounting pressure, high street banks have released their own sustainability statements, promising to ‘finance a greener future’. But discerning customers will note that the Big 4 consistently score near the bottom on ethical finance ratings because they invest trillions in fossil fuels.

What challenger banks and FinTechs bring to the table when it comes to ethical finance is consumer choice. With no excuse for apathy, businesses that brand themselves as ethical must think carefully about which financial institutions they want to align themselves with. In turn, banks must consider how they can improve their standards beyond surface-level PR campaigns – particularly as the environmental crisis deepens and sustainable finance develops from a fringe topic to headline news.

Global expansion

According to a survey by Airwallex, 77% of UK businesses intend to expand their international presence this year. Global expansion used to be a costly venture, with banks charging high transaction fees and FX rates for cross-border transfers and payment acceptance. Businesses could reduce these fees by opening multiple foreign currency bank accounts, but this created a disjointed banking experience and racked up additional account management costs.

Payment solutions like Airwallex solve this problem by allowing businesses to collect, hold and send multiple currencies from a single account and by offering a more competitive FX rate compared to traditional business bank accounts. For ecommerce businesses, this is a game-changer. Using a multi-currency solution, businesses can collect payments in local currencies around the world without excessive fees. In short, ‘going global’ is no longer an option but a no-brainer, particularly for ecommerce companies. This is why the cross-border ecommerce market is set to grow by an annual CGAR of 27% over the next four years, and FBA aggregators (companies that buy up small Amazon sellers and take them global) have successfully raised billions of dollars from investors.

Technology

The finance industry has a reputation for being tech-phobic – banks still rely on solutions like BACs and SWIFT that haven’t changed much since the 1970s. But times are changing, and FinTech is going through a renaissance which sees no sign of abating.

Modern payment solutions use local banking routes to transfer money across borders faster and more cheaply than SWIFT, accountants use software to automate bookkeeping and forecasting, and everyday investors are moving away from traditional stockbrokers onto WealthTech apps like Plum and Stake. That’s before you consider the impact of blockchain and crypto. Ultimately, tech is making life significantly easier for businesses. From automating manual tasks such as expense management and payroll, to enjoying fast access to forecasting and risk data.

The trouble is that traditional financial institutions are not designed for rapid change. The Silicon Valley motto – ‘move fast and break things’ – is a far cry from the culture in most banks, and this lack of agility has made it difficult for them to compete with smaller, tech-focused companies.

So, what we’re seeing now is larger financial institutions buying up tech companies and investing in white label solutions in order to deliver a better digital service for clients. In June 2021, JP Morgan acquired the online investment platform Nutmeg ahead of the UK launch of its digital bank; Lloyds recently partnered with cash management platform Satago to ‘reinvent invoice financing for UK SMEs’; and Goldman Sachs is reportedly making moves to buy Nucleus.

Looking to the future

FinTechs and challenger banks have injected some much needed competition into the business finance market, and drawn attention to the issues that matter to modern businesses – customer service, platform usability, tech innovation, low fees and high ethical standards. With so much choice available, businesses are now thinking carefully about where they put their money, not just how they make it. And as expectations rise, the financial services industry has been forced to become more consumer-focused. Traditional providers can no longer afford to be complacent, and those that fail to adapt will continue to lose customers to slicker and cheaper competitors.